And yet 2 out of 3 adults around the world

struggle with financial literacy + confidence

Add to that mix the volatile nature of entrepreneurial income and you have everything you need to spend the rest of your life settling for less.

Which is why I’ve dedicated myself and this website’s resources to helping you learn how to do MORE WITH MONEY.

Not just for the sake of having a big bank account (because it’s not really about the money, is it?).

But for the sake of the life that matters to you!

— ◆ —

I want you to be able to

build the business of your dreams,

live a meaningful, purpose-filled life,

and do what you feel called to do

with the people you care about most.

— ◆ —

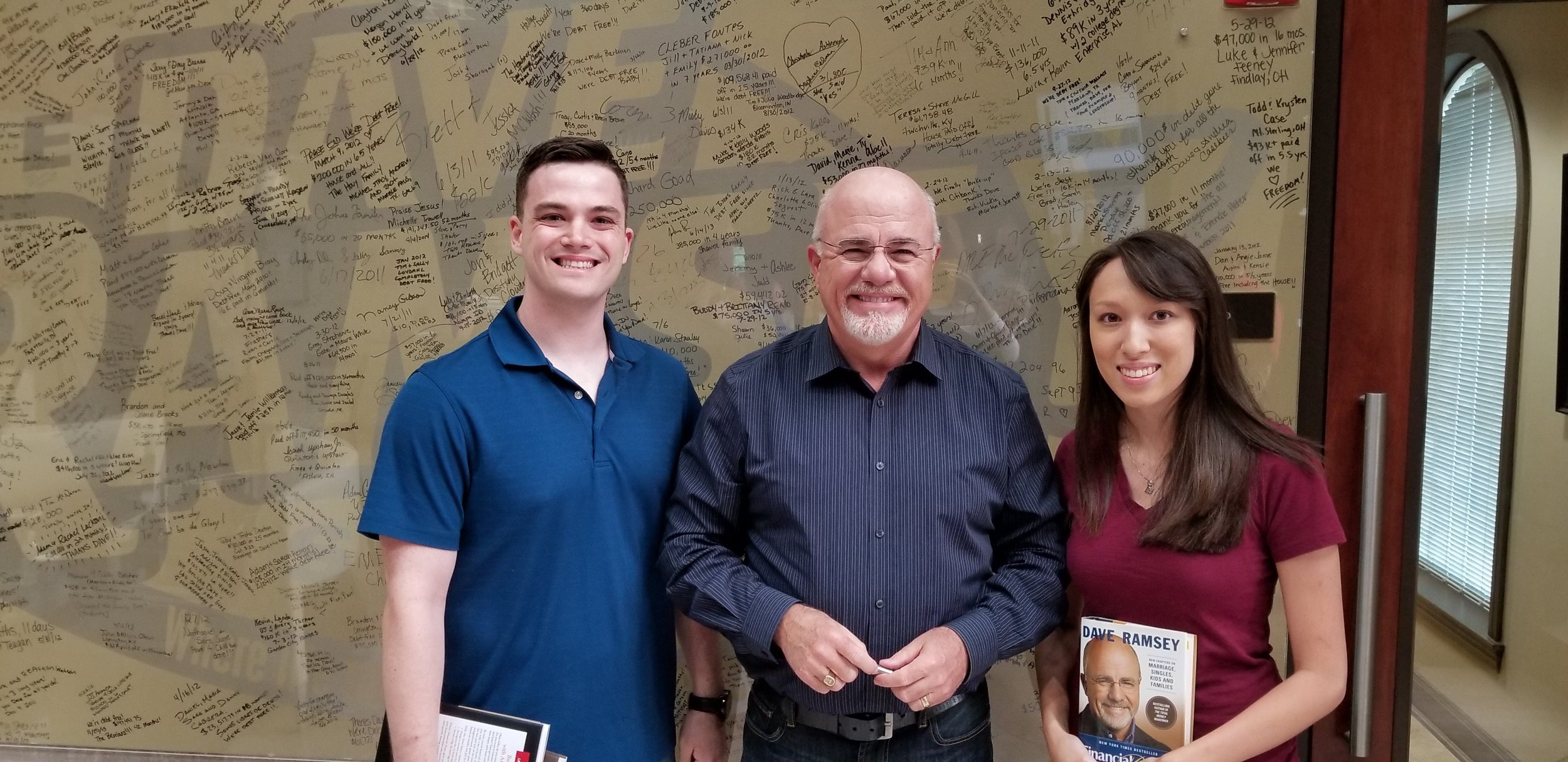

MEET KATIE SCOTT

NERD. DOG MOM. CHRONIC COUCH POTATO. MONEY MANAGEMENT ADVOCATE.

I started my financial journey as a college accounting student who struggled to understand ANYTHING about money. I thought becoming an accountant would make me a finance wizard and pay the bills.

Instead, I burnt out almost overnight. My priorities were out of whack, I felt like my work wasn’t helping the clients I served, and I STILL didn’t know how to manage money.

Hot Take: Knowing how to do taxes or bookkeeping doesn’t mean you can manage money well.

So I quit my job, moved back home, and poured my heart into unlocking the secrets of healthy, sustainable, fun, and freeing money management. I experimented with new systems and learned how to make better financial decisions. And I began working with entrepreneurs all over the world to help them do the same.

And here’s what I learned: There is no secret app, PDF download, investing product, or formula that’ll make you financially well. That power lies directly with you.

You have the power to shift the way you approach money NOW. And once you do, you’ll never be the same.

When You Step Into MWM's World...

You’ll get access to the resources and trainings that will nurture your financial decision-making power, cultivate your CFO-level skills, and instill a newfound sense of confidence, hope, and even FUN when it comes to money.

I am here to be your guide, your mentor, and your financial BFF on this journey.

I want to show you a new way of thinking about money. And I want to help you discover the system and strategies that uniquely serve your life and business needs. You won’t find a one-size-fits-all financial approach around here - because that magic pill doesn’t exist.

But you WILL find concrete practices, proven principles, and a whole lotta grace + love.

What They Say…

“She has an incredible gift at taking concepts that financial gurus make sound so complicated and making them simple.”

“I now have a better grip on finances in my business and a step-by-step action plan for improving things long-term.”

“I feel more confident...that it doesn’t have to be difficult. She is an excellent teacher and I love how easy she makes everything!”

“Having someone like Katie teach me ways to track, manage, and feel good about my finances, now that’s an investment worth making!”

What else would you like to know?

Where is home?

Lifelong Floridian who dislikes beaches

Where would you like to travel?

Taiwan, to see where my mom was born

Any guilty-pleasures?

Movie: Another Cinderella Story with Selena Gomez

Game: Minecraft 🤓

Book: Midnight Sun by Stephenie Meyer

What do you collect?

I’m the girl with multiple editions of the same novel.

Current financial focus?

Preparing to welcome Baby #1 in Sept ‘23! 💕

What motivates you?

Living a lifestyle and having the resources that allow me to serve others’ needs

Favorite hobby?

Hobbies! I love learning & exploring, everything from technical skills to art mediums.

Can you make me mad?

My husband’s name is Michael Scott but neither of us has formally watched The Office 😬

So, How Can I Help?

Learn From the Library

Welcome to the Library.

Paradigm Shift (n): an important change that happens when the usual way of thinking about or doing something is replaced by a new and different way

Learn more about your business and experience your financial paradigm shift in the free + binge-worthy More With Money Library.

Start with the CFO Kit

Spoiler alert: It’s free.

And when you see it, you’ll wonder how you got this without paying for it.

Get the tools and training you need (+ deserve to know) to kickstart financial clarity for your business today. This is NOT another basic “budget template” freebie.

Book a Money Talk

Give your people valuable money content.

Have an audience of business owners with questions about money management? Does your program need a dash of money magic sprinkled in?

Explore the different ways I can help you serve your people as a guest expert for your team or your community.